Did you know that over 60% of property buyers in Singapore face financial gaps between selling their current homes and purchasing new ones? This statistic shows how important bridging loan calculators are. A bridging loan calculator in Singapore is key for both buyers and sellers. It gives a quick and accurate estimate of the loan amount needed.

This guide is here to help you use a bridging loan calculator well in Singapore’s busy property market. Knowing how to use this tool can help you make smart financial choices. It also ensures your property financing goes smoothly during transitions.

Understanding Bridging Loans

Bridging loans is vital for those needing short-term funds to buy a new property. This is while they’re still waiting on the sale of their old one. In Singapore, where the property market moves fast, these loans help keep deals moving.

What is a Bridging Loan?

A bridging loan is like a temporary bridge, helping you buy a new home before selling the old one. It stops the wait for sale money from slowing you down. This way, people can smoothly move from one property to another.

When to Use a Bridging Loan

They’re great for times you need quick cash during property changes. For instance, someone in Singapore selling their old home can use this. It lets them buy a new place before their old home sells, avoiding gaps.

Benefits of Bridging Loans

Bridging loans offer a lot of financial flexibility for those waiting to sell. This means you can easily upgrade or downgrade your property without stress. Singapore’s lively housing market, makes it easy to move on new deals quickly, not tied down by your old home’s sale time.

How Bridging Loan Calculators Work

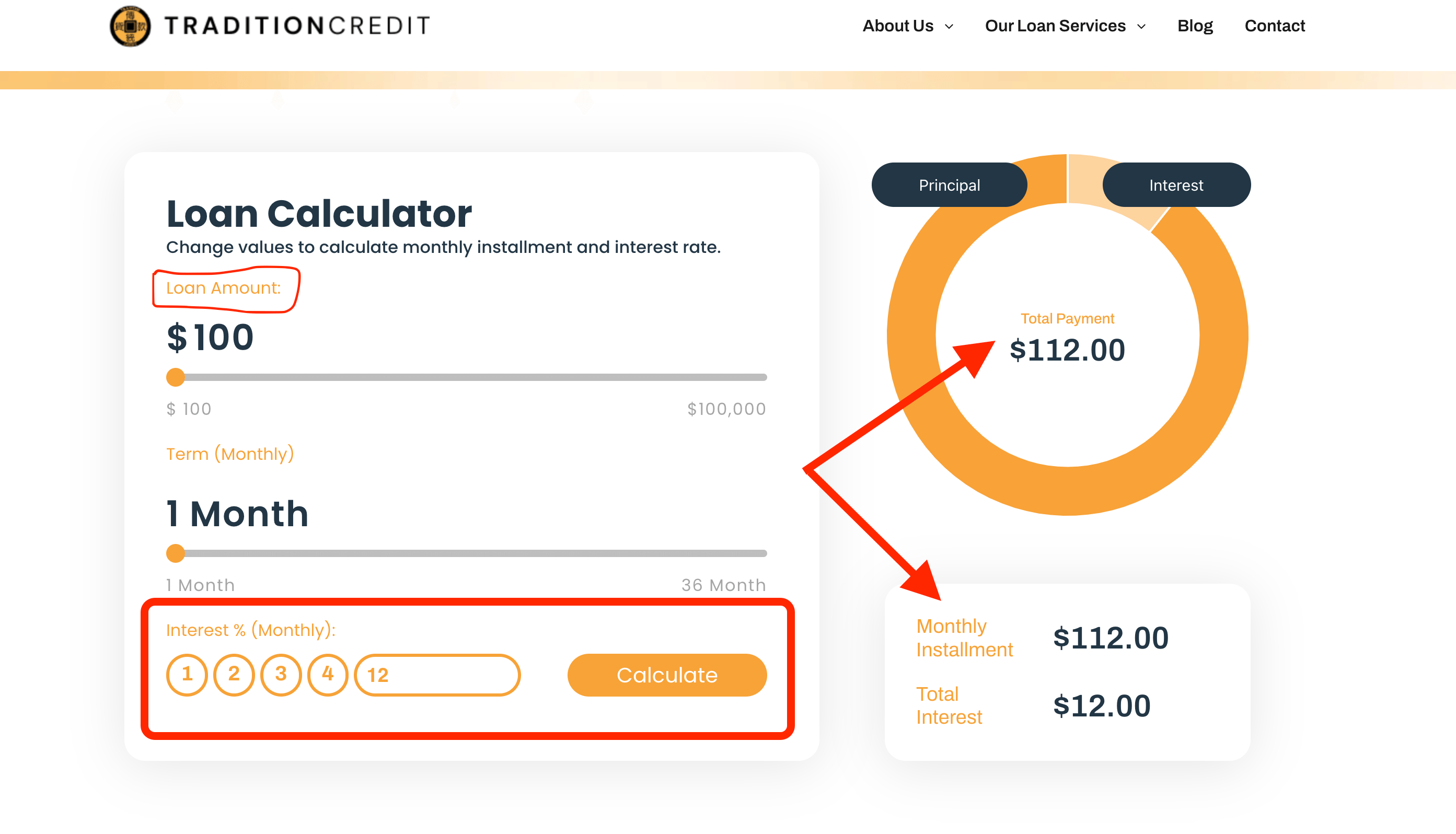

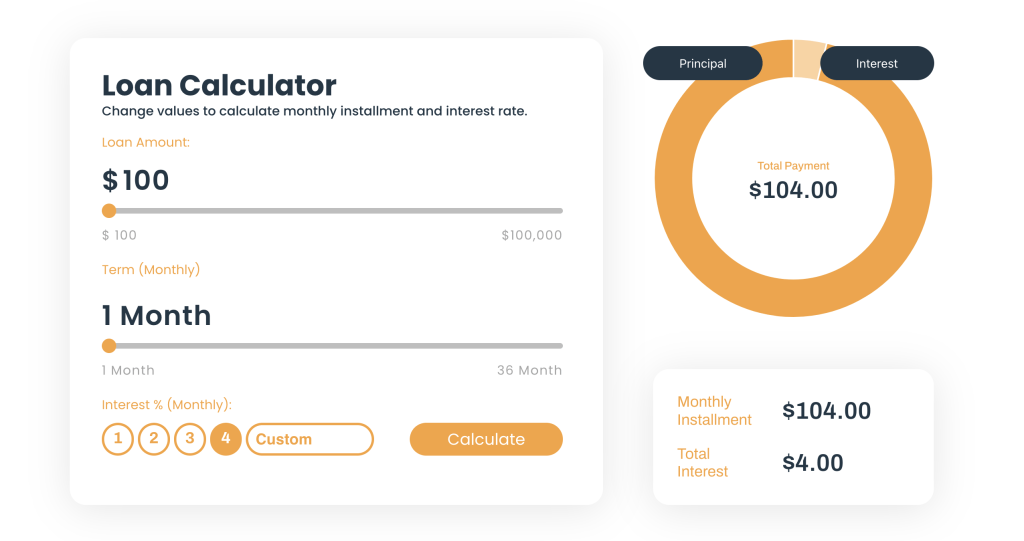

Understanding bridging loan calculators helps property buyers and investors in Singapore. These online financial tools make it easy to guess potential loans. Users can see all the necessary info, like input, the math used, and the final results. This makes smart choices possible in property deals.

Input Parameters

To make the online financial tool work for you, put in specific info. You’ll need the loan size, interest rate, and how long you’ll take to pay it back. Accurate information gives a trustworthy estimate, showing what you might owe. Key parts to think about are:

- Loan Amount: The total borrowed money.

- Interest Rate: The lender’s charge percent.

- Loan Tenure: How long you have to repay.

Calculation Mechanism

At its core, a bridging loan calculator turns your information into probable monthly payments. It uses complex math to mix interest rates and payback times. The online financial tool is simple to use, masking the hard math it’s doing. This way, it gives quick and accurate answers.

Output Results Explained

The calculator’s answers show a detailed payback plan. You’ll see monthly payments, total interest, and overall loan fees. This clarity helps with cash flow management. It lets users plan their financials with certainty. Here’s what the result might look like:

| Parameter | Value |

|---|---|

| Monthly Repayment | $1,500 |

| Total Interest Payable | $5,000 |

| Total Loan Costs | $105,000 |

Understanding these results helps property buyers handle their cashflow management and loan schedules better.

Advantages of Using a Bridging Loan Calculator

Using a bridging loan calculator helps a lot in Singapore’s lively real estate scene. It’s a key tool for buyers and sellers. It offers several benefits for smart financial planning.

Time-Saving Benefits

One big plus is how much time it saves. It gives quick, exact loan forecasts. This lets borrowers know their financial state quickly. Quick data is perfect for meeting tight property buying or selling deadlines.

Accuracy and Precision

Getting numbers right is a huge plus. The tool is spot-on for making the right decisions. These precise loan predictions help manage risks well. They also improve financial plans in Singapore’s real estate game.

How to Use a Bridging Loan Calculator Singapore

For those in Singapore’s real estate market, a bridging loan calculator is a must-have. Knowing how to use it right is key to getting accurate results. We’ll show you step by step and what not to do.

Step-by-Step Guide

- Access the Calculator: Begin by finding a trusted bridging loan calculator for Singapore’s unique financial scene. You can find these tools on many bank and financial websites.

- Input Loan Amount: Put in the total loan amount you think you’ll need. This figure should be the difference between your current property’s sale price and the new property’s cost.

- Select Interest Rate: Pick the interest rate carefully. Make sure you know the latest rates or use what your lender has told you.

- Set Loan Tenure: Decide how long your loan will be. Bridging loans are usually for short periods. Choose a time that fits when you plan to sell your old place and buy a new one.

- Review Results: The tool will show you a payment schedule and how much the loan will cost overall. This information is vital for planning your finances.

Common Mistakes to Avoid

- Ignoring Market Fluctuations: Remember, interest rates can change. Not thinking about this can cause big mistakes.

- Incorrect Data Entry: Double-check that all the info you put in is right. Mistakes often come from putting in the wrong numbers.

- Overlooking Additional Costs: Don’t forget about extra fees or charges on the loan, not just the interest rate.

- Lack of Scenario Planning: Test out different situations with the tool. This will help with better financial planning, like if rates change or the length of your loan.

Use this guide to avoid common mistakes and get the most out of bridging loan calculators. This way, your financial planning will be accurate and smooth.

Essential Factors to Consider When Using a Bridging Loan Calculator

When you use a bridging loan calculator for Singapore’s real estate, it’s key to look at many factors. This helps with good financial planning and makes property deals smooth. Knowing these factors is important for making wise choices.

Interest Rates

Interest rates are very important when you think about the cost of a bridging loan. It’s smart to keep an eye on the rates that banks in Singapore offer. Even a small change in rates can greatly affect how much you pay for the loan.

Loan Tenure

How long you have to pay back the loan is a big deal too. Understanding different loan lengths can show you how it changes your monthly payments and interest. Picking a shorter time to pay means you might pay more monthly but less in total interest. This is key for managing your money well.

Repayment Options

Many financial institutions offer different ways to pay back loans. You might choose to only pay the interest for a while, or make the same payment every month. Knowing your options helps in picking a plan that works with your budget and goals. It makes it easier to manage your money and pay back the loan.

| Factor | Impact |

|---|---|

| Interest Rates | Determines the overall cost of the loan based on current rates. |

| Loan Tenure | Influences monthly repayment amounts and total interest payable. |

| Repayment Options | Offers flexibility in how the loan is repaid, affecting cash flow management. |

It’s crucial to think about all these elements when figuring out a bridging loan. Including the right interest rates, loan length, and how you’ll pay back helps tailor the loan to what you need and your goals. This careful thought is essential for a successful deal in the Singapore property scene. It makes financial management smoother and ensures you’re making a solid investment.

Top Bridging Loan Providers in Singapore

In Singapore, many options exist for bridging loans. Major banks and financial institutions offer these with different terms.

Major Banks Offering Bridging Loans

Tradition Credit, OCBC, UOB, and Maybank are key players. They design their loans to fit various financial needs.

| Financial Institution | Interest Rates | Loan Tenure | Customer Service |

|---|---|---|---|

| Tradition Credit | 4% – 4.25% | 1 to 12 months | Excellent |

| OCBC | 4.00% – 5.00% | 6 to 12 months | Very Good |

| United Overseas Bank (UOB) | 4.50% – 5.25% | 6 to 12 months | Excellent |

| Maybank | 4.20% – 4.90% | 6 to 12 months | Very Good |

Criteria for Choosing a Provider

Picking a loan provider in Singapore involves comparing key aspects. Look at the bank’s reputation, loan terms, and customer service quality.

Reputation is important because well-known banks are often more trustworthy. They tend to have clear terms. It’s crucial to review the loan’s interest rates, tenure, and repayment flexibility. These factors help in making the right choice.

Good customer service also plays a role. It can make your loan experience smoother, helping you handle your finances better.

Case Studies: Successful Use of Bridging Loans

Bridging loans help many in Singapore’s property market. They act as a financial bridge at key points. This has shown us how effective financial plans with bridging loans lead to property success.

Real-Life Examples

A young couple used a bridging loan to switch from selling their flat to buying a condo. They used the loan for their condo’s deposit. This move saved them from renting temporarily and from spending more money.

A professional coming to Singapore also used a bridging loan. It helped them buy a new property before their old one sold. This let them secure their new home without delay or much stress.

Lessons Learned

These stories teach us important lessons for the Singapore property scene. They tell us timing is crucial. Using a bridging loan smartly can reduce the pressure of fast property deals.

They also show how knowing your finances and getting the right loan help a lot. Early advice from experts avoids problems. The right strategy with bridging loans can bring good results in Singapore’s lively property market.

Comparison Between Bridging Loans and Other Loan Types

It’s essential to understand the differences between loan types in Singapore. Bridging loans, term loans, and mortgages each have their unique uses and advantages. This helps in making wise financial choices.

Bridging loans offer quick cash to buy a new property before selling the old one. In fast-moving real estate markets like in Singapore, they are ideal. The main benefit is quick access to funds. However, they often have higher interest rates.

| Loan Type | Purpose | Interest Rates | Repayment Terms |

|---|---|---|---|

| Bridging Loans | Short-term financing for property purchases | Generally higher | Typically, up to 12 months |

| Term Loans | General-purpose funding | Moderate | Fixed tenure from 1 to 5 years |

| Mortgages | Long-term property financing | Usually lower | Up to 30 years |

Term loans have fixed repayment plans and are used for many financial needs. They have moderate interest rates and timeframe flexibility. This helps those wanting both quick funds and easy monthly payments.

Mortgages offer the lowest rates for buying homes, with repayments up to 30 years. They provide affordable monthly payments. Yet, they have longer and more detailed application processes.

If you’re moving properties in Singapore, you should think about your mortgage and bridging loan options. This will help you pick the loan type that matches your financial plans and schedule.

Common Misconceptions About Bridging Loans

It’s key to understand bridging loans in Singapore for smart property finance choices. Many think these loans come with very high interest rates that lead to big debts. But, the rates are higher than normal loans because they’re used for short periods. They help when you need money quickly.

Some people believe getting a bridging loan is a long, slow process. But in Singapore, many banks have made it quicker. They know the real estate world moves fast and have made their processes fast too.

One big myth is that only big property developers can use these loans. This isn’t true. Bridging loans are also good for people moving homes. They make the switch easier without causing financial worry.

| Myth | Reality |

|---|---|

| Bridging loans have excessive interest rates | Interest rates are higher but designed for short-term needs |

| Approval process is extensive and slow | Many providers offer quick approvals to meet market demands |

| Only large-scale developers can utilize bridging loans | Individual homeowners can also benefit from bridging loans |

By learning the truth about bridging loans, borrowers can make better choices. These loans are useful during changes in the real estate market. They offer a way to manage money smoothly during these times in Singapore.

Tips for Getting the Best Rates with a Bridging Loan Calculator

Getting a good rate on your bridging loan in Singapore needs good negotiation and knowing about fees. Using a bridging loan calculator helps pick the best deal. But, understanding how the process works is key to getting a good loan.

Negotiation Strategies

To get a great deal on your bridging loan, you must be a good negotiator. Start by looking at different lenders’ offers and compare them. Know about their rates, how long you can have the loan, and any other terms.

When talking with lenders, mention your credit score and any good offers you’ve seen. This might help you get a lower rate. Also, getting to know your loan officer can help. They might share tips or advice that could be really helpful.

Understanding Fees and Charges

It’s not just the interest rate that matters. There are other costs to consider, like application fees and legal fees. You could also face charges if you pay the loan back early. Knowing about these costs with a calculator can help you see the whole loan’s cost.

This knowledge can help you make better decisions. It ensures you won’t be surprised by hidden costs. This can make borrowing money cheaper in the long run.

Learning to negotiate well and understand all loan costs helps in using bridging loan calculators effectively. It’s not just about getting the best rates. It’s also about making sure the whole process of getting a loan is seamless and smart for your finances.

Conclusion

By utilizing the bridging loan calculator, individuals can gain a clear understanding of the financial implications associated with taking out a bridging loan. This can help them assess whether this type of loan is the right fit for their needs and financial situation. With the ability to input different variables such as loan amount, interest rate, and loan period, users can customize the calculations to suit their specific requirements.

Moreover, the bridging loan calculator Singapore can empower individuals to explore various scenarios and make comparisons. They can assess different loan options, adjust loan terms, and evaluate potential outcomes. With this tool, they can determine the most favorable conditions and make well-informed decisions based on the financial projections provided.

In summary, the bridging loan calculator Singapore offers a convenient and efficient method of estimating costs involved in taking out a bridging loan. By providing accurate calculations and the ability to customize variables, it enables individuals to make informed decisions and assess different loan options. Whether it’s for personal or business use, utilizing this calculator can ensure financial clarity and aid in making sound financial choices.

FAQs – Bridging Loan Calculator In Singapore

What is a bridging loan calculator?

A bridging loan calculator is a tool that allows you to estimate the amount you can borrow, the interest rates, and the repayment period for a bridging loan. It takes into account factors such as your income, credit score, and the value of the property you intend to purchase or sell.

How can a bridging loan calculator help me?

By using a bridging loan calculator, you can get a clear picture of the financial implications of taking out a bridging loan. It helps you determine how much you can afford to borrow, what your monthly repayments will be, and the total cost of the loan. This enables you to make an informed decision and plan your finances accordingly.

Where can I find a bridging loan calculator in Singapore?

Bridging loan calculators are readily available online. Most financial institutions and loan providers in Singapore like Tradition Credit have their own calculators on their websites. It’s advisable to use multiple calculators to compare the results and ensure accuracy.